GameStop Stock Falls Following Short Squeeze Conditions

Photo Courtesy of Congressional Research Service

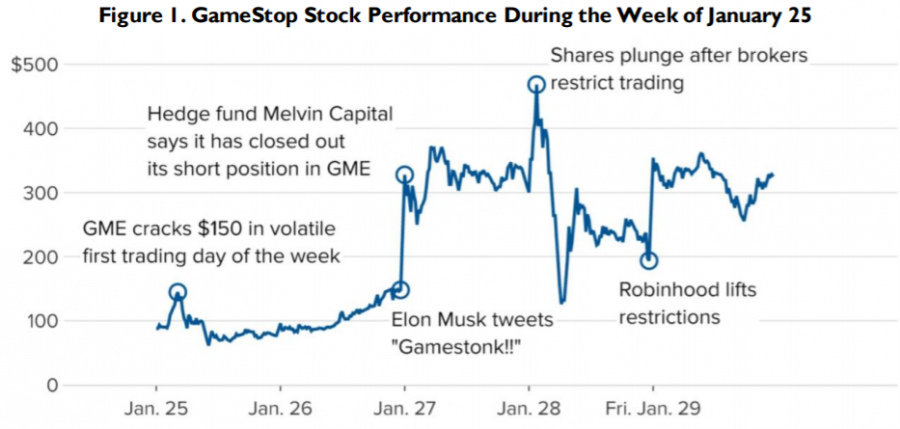

Using data from CNBC and FactSet, researchers at the Congressional Research Service created a timeline of GameStop share prices and major events that could have contributed to fluctuations in the company’s stock for members and committees of Congress.

Users on the stock trading subreddit r/wallstreetbets sounded the alarm in late January that brick-and-mortar video game chain GameStop was being shorted past its number of publicly available shares, leading to a market frenzy for a stake in the publicly traded company that temporarily drove up the stock price; the stock has since tumbled to $60 a share.

GameStop’s stock, traded on the New York Stock Exchange under the ticker GME, reached a peak of $483 per share on Jan. 28, marking an increase of more than 18,000% in share price compared to its year-to-date low of $2.57 per share in April 2020.

“I err on the side of caution. I got in a bit later and pulled out a little earlier,” longtime investor and senior Brian Chen said. “If you want to talk about percentage returns, I think I got up to about 50%.”

This rush in market demand was caused in part by major financial institutions betting that the stock would decline, or “shorting” the stock. The practice involves investors borrowing shares of the stock, selling them immediately at borrowed value, and then buying their allotted shares at a later time.

If the price of the stock decreases after it is borrowed, investors holding a short position pocket a profit calculated from the difference between the borrowed and bought share price. When the price of a shorted stock rises, however, investors must pay the difference between the borrowed and bought stock values, leading to an overall loss.

On Jan. 22, about 140% of GameStop’s publicly available stock, or public float, was shorted, according to fintech firm S3 Partners for Business Insider. Collectively, the high demand for GameStop shares and the relatively low supply of available stock created a short squeeze for the retailer.

With the price of GameStop falling to $90 a share to close on Feb. 2, investors holding more than half of these shares — 37.24 million shares, worth $8.4 billion in total — left their short positions, according to S3 Partners.

“If long shareholders begin to sell their positions, expect short sellers to jump in and help GME’s stock slide continue,” S3 managing director Ihor Dusaniwsky said in a company article. “But if long shareholders see the tumbling stock as a new buying opportunity, we may be at the start of part deux of the GME short squeeze.”

Some major financial institutions, including hedge funds, whose managers strategize to generate active returns for investors, have followed the tune of retail investors’ sentiments and made windfalls from GameStop, while others have recorded major losses.

New York-based hedge fund Glenview Capital Management has recorded 6.4% in returns in January, totaling $3.5 billion worth of assets under management, according to Bloomberg. On the other hand, Melvin Capital Management, a premier hedge fund that held a short position in GameStop, lost 53% of its investments in January alone and received $2.75 billion from hedge fund Citadel LLC, according to the Wall Street Journal.

Apart from enthusiastic support from retail investors, business moguls have expressed their support for the r/wallstreetbets community that rallied for the purchase of GameStop stock. On Jan. 26, Elon Musk tweeted a reference to GameStop and linked the subreddit’s homepage, and investor Mark Cuban hosted an Ask Me Anything session with users of r/wallstreetbets a week later.

The Reddit subforum has also experienced an unprecedented influx of members since GameStop became a major topic of discussion among users, jumping from about 2 million subscribers in the beginning of 2021 to more than 8 million. According to r/wallstreetbets member and senior Trung Huynh, this may lead to a flurry of enthusiastic investors unaware of traditional investing strategies.

“I think a lot of new members think of the stock market as free money or an ‘it can’t go wrong’ kind of thing,” Huynh said. “I think that we’re gonna have to educate a lot of people on the basis of investing.”

The community has also faced its share of controversy, especially for its use of disparaging terminology to refer to its users.

On Jan. 27, r/wallstreetbets’ Discord server, which allows members to communicate with one another through instant messaging and voice chat, was shut down “for continuing to allow hateful and discriminatory content after repeated warnings,” a spokesman for Discord Inc. said to the Verge. “To be clear, we did not ban this server due to financial fraud related to GameStop or other stocks.”

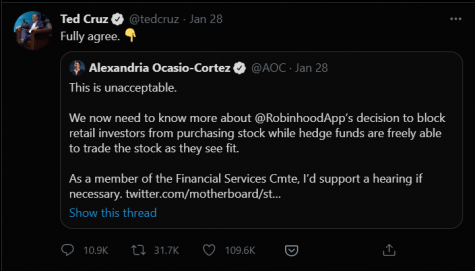

Brokerage and stock trading app Robinhood — a popular option for retail investors, including members of r/wallstreetbets — was mired in controversy after preventing users from purchasing shares of GameStop on Jan. 28, leading to falling share prices and drawing criticism from lawmakers populating both sides of the aisle, from Democratic Rep. Alexandria Ocasio-Cortez to Republican Sen. Ted Cruz — a rare show of bipartisanship in a politically split Congress.

Retail investors have also retaliated against the Silicon Valley-based firm, filing a class-action lawsuit against Robinhood on Jan. 28 and posting a slew of one-star reviews on the app’s Google Play store page.

“We absolutely did not do this at the direction of any market maker or hedge fund,” Robinhood CEO Vlad Tenev said in an appearance on CNBC. “The reason we did it is because Robinhood as a brokerage firm, we have lots of financial requirements.”

Tenev is expected to testify before the House Financial Services Committee chaired by Rep. Maxine Waters on Feb. 18 regarding Robinhood’s closure of buying options for GameStop.

“I’ll be looking forward to that,” Chen said. “Even with Congressional inquiry, though, I highly doubt anything will come out of it. Maybe just a slap on the wrist, a $5 million fine, but who knows how much money they made behind the scenes.”

President Joe Biden’s transition into office has also ushered in a number of nominations to various agencies in Washington. However, his nominee for the Securities and Exchange Commission, Gary Gensler, has yet to testify in a confirmation hearing hosted by a politically-split Senate.

The recent events surrounding GameStop will likely be discussed during Gensler’s hearing as the nonpartisan Congressional Research Service, which prepares insights for members of Congress, published a Feb. 3 report on the GameStop short squeeze and lawmakers such as Sen. Elizabeth Warren publicly opined on the matter.

“The Commission must review recent market activity affecting GameStop and other companies and act to ensure that markets reflect real value, rather than the highly leveraged bets of wealthy traders or those who seek to inflict financial damage on those traders,” wrote Sen. Elizabeth Warren in a Jan. 29 letter to the SEC. “To protect and restore public trust in sound securities regulation and enforcement, the Commission must identify gaps in existing securities laws and rules and ways in which the Commission can improve its enforcement capabilities.”

Your donation will support the student journalists of Portola High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Ryan Jung is the co-managing editor of the Portola Pilot. He is looking forward to working in the newsroom three times a week and communicating with Pilot...