Financial Literacy Must Be Mandatory in High School

Since a lot of kids in Irvine are financially dependent on their parents, once they enter college, they are hit with a whole new realm of problems they have never learned to deal with. “Especially growing up in a pretty affluent area such as Irvine, I’ve never really had to worry about dealing with money problems. But now that I’m a senior in high school, with the independence to drive, have a job and whatnot, I’m really worried for my future and balancing life with financial issues,” senior Faith Nguyen said.

February 18, 2020

Instead of studying valuable lessons about responsible money decisions, high schoolers seem to be in a repetitive regime of memorizing information that is rarely applicable to real life. According to a survey commissioned by H&R Block, out of 2,000 working adults, fifty-seven percent felt a course on money management in high school would have been helpful for them.

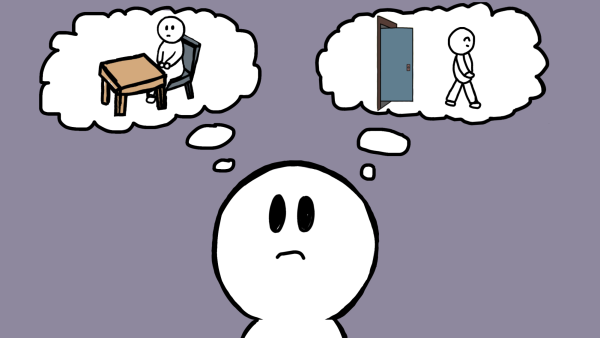

“Financial literacy, in terms of all student loans, how to pay it off, interest, those were all foreign concepts,” Campus counselor Ryan Itchon said. “I feel like if I had a better understanding of my finances, I’d be less scared to tackle it on my own.”

If we can get parents to become more aware of the impact their having on their kids when they’re trying to hold their hand through life, [we can prevent] their kids from falling down

— Kris Linville

In the post-high school real world, almost everything in life boils down to money; it seems bizarre that high schools do not put more effort into publicizing resources about how to wisely manage finances.

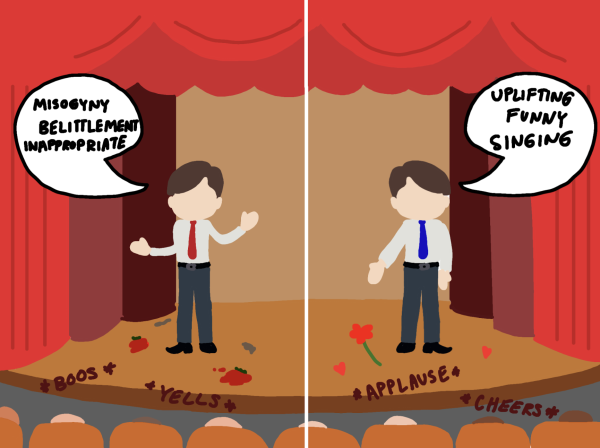

Even with classes like consumer math and AP Macroeconomics that teach students the technicalities of the economy, not many students take these courses.

“Consumer math is seen as a math course which is ‘below’ many students at the school and has the negative connotation as being the class for people bad at math,” senior Raghav Pant said. “As for AP Macro, I suppose it’s because most seniors don’t really want to take courses which are too difficult and make their senior year any harder.”

Implementing any sort of mandatory course in a high schooler’s general education would allow students to grasp practical skills for their future in the college and career world.

In University College London, the professors are revamping their curriculum with lesson plans from “The Core Project” which aims to teach students a new way to learn about the economy. This inclusion has shown results in the way students perform and understand economics.

“In both micro- and macroeconomics, the CORE cohort did on average significantly better than their non-CORE counterparts,” Professor Antonio Cabrales of University College London said on the Core Project’s blog. “This approach seems to pay off when it comes to learning and understanding a more technical treatment of economics.”